Four ways to make money to fund your small business include bootstrapping, securing a small business loan, launching a crowdfunding campaign, and seeking angel investors. Explore these options to turn your business idea into reality by efficiently gathering the necessary capital.

Starting and funding a small business can be a formidable challenge for many entrepreneurs. Securing capital is a critical step that determines the fate of an emerging enterprise. Crafting a solid financial foundation allows aspiring business owners to translate their vision into a sustainable operation.

Presenting a quick guide to monetizing strategies, this article seeks to empower individuals with practical avenues for generating funds. Acknowledging diverse financial scenarios, the suggestions provided aim to cater to a varied audience, ensuring that different funding needs can be met. Whether you’re embarking on a fresh venture or looking to expand, these methods can pave the way for your business’s financial success.

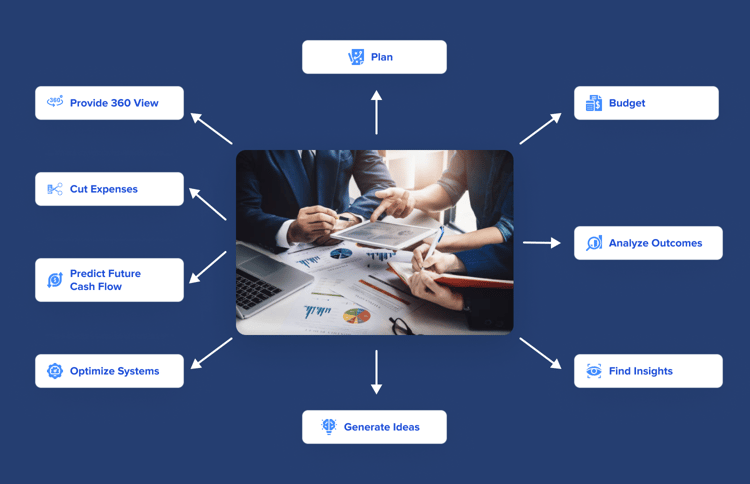

Credit: www.plooto.com

Introduction To Funding Your Small Business

Finding money for a new business can be tough. Banks often say no. Investors are hard to please. Credit scores play a big role.

Owners must show they can pay back. Trust takes time to build. Getting enough money is a huge step.

Good cash flow keeps a business alive. It means paying bills on time. A strong cash flow can attract investors. It shows that a business is healthy.

Tracking money is key. Owners should know where every penny goes. Smart spending helps save for future needs.

Bootstrapping: Self-funding Your Business

Bootstrapping means using your own capital to finance your small business. This approach avoids debt and equity funding, giving you full control over decisions. By investing personal savings, you demonstrate commitment to potential investors. Creating a strict budget is crucial to maximize your personal investments.

To increase bootstrapping funds, consider a variety of strategies. Cut unnecessary expenses to keep money within the business. Sell items you don’t need for extra cash. Invest in solid business plans and wise financial choices to grow your capital. Consistent reinvestment into the business can lead to long-term success.

Crowdfunding: Rallying Community Support

Crowdfunding is a way to make money from many people online. People look at your idea and decide if they want to give you money. The money is for making your business dream real. Popular crowdfunding platforms like Kickstarter and Indiegogo help a lot. They let you show your business to the world.

Creating a good campaign is key. Tell a story that touches hearts. Show why your business is special. Share pictures and videos that pop. Make sure your rewards are cool. People love getting something back. Updates are important too. They make people feel part of your journey.

:max_bytes(150000):strip_icc()/Cashconversioncycle-f39bee15fd174aae897c72466b2449ff.jpg)

Credit: www.investopedia.com

Small Business Loans & Grants: Navigating The Process

Securing funding for a small business is a vital step. Before applying for loans and grants, it’s important to gather all necessary documentation. Research the specific requirements for each option. Many programs have strict eligibility criteria. Ensure your business meets these criteria to improve your chances of success.

To increase the likelihood of a successful application, present a solid business plan. Show how the funds will contribute to your business’s growth. Lenders and grant committees look for clear financial projections and a strong repayment plan. Be ready to explain your business model concisely. Assistance from a financial advisor can be invaluable during this process.

Alternative Funding: Exploring Creative Solutions

Exploring creative solutions for funding is key to your business growth. Venture capital could offer considerable amounts. They want a stake in your business. Another route is angel investors. They support startups with money and advice.

Don’t overlook revenue-based financing. This means you pay back with a percentage of your sales. Peer-to-peer lending is also an option. Here, other people become your lender through online platforms. It’s simpler and often faster than traditional bank loans.

Conclusion: Cultivating A Sustainable Financial Strategy

To thrive financially in your small business, striking a balance is key. Short-term needs should not overshadow your business’s long-term growth. This practice ensures you won’t sacrifice future gains for present benefits. Invest profits wisely and look for opportunities to reduce costs intelligently.

It’s also essential to embrace learning and adaptability. Change is constant in business, so staying updated with market trends keeps you ahead. Equip yourself with new skills and knowledge. This will help you make informed decisions, maximizing earnings and securing your business’s future.

Credit: www.plooto.com

Conclusion

Embarking on your entrepreneurial journey shouldn’t be stifled by financial constraints. We’ve explored four innovative paths to monetize your talents and unlock funds for your business. Take action, leverage these strategies, and propel your startup to new heights. Success awaits the bold—fuel your venture today!