Accepting cryptocurrency can diversify your payment options and attract tech-savvy customers. It’s important to understand the potential benefits and risks involved.

As a business owner striving to stay ahead in today’s fast-paced market, considering the integration of cryptocurrency as a payment method could give you a competitive edge. This form of digital currency is gaining traction among consumers who value privacy, security, and the convenience of quick, borderless transactions.

By incorporating cryptocurrency, you not only meet the needs of a growing demographic but also showcase your brand as innovative and adaptable to emerging technologies. To get started, you’ll need to set up a digital wallet, choose a payment processor, and ensure compliance with the legal and tax regulations in your jurisdiction. Embracing cryptocurrency can enhance your market presence, potentially reduce transaction fees, and provide an additional layer of financial security through the blockchain technology that underpins digital currencies.

The Rise Of Cryptocurrency In Commerce

The digital payment landscape is changing fast. Many stores now say “yes” to cryptocurrency. Why? Cryptocurrency makes buying and selling easy online and in person. It’s a new way to pay that’s gaining fans worldwide. People like crypto for its quick transactions and low fees. Stores take crypto to attract more customers.

- Speed: Crypto transactions are done in minutes.

- Security: Crypto keeps buyer and seller details safe.

- Global reach: Anyone with internet can use crypto.

- No big fees: Crypto cuts down on transaction costs.

Advantages Of Accepting Crypto Payments

Embracing cryptocurrency as a payment method can lead to substantial reductions in transaction fees. Traditional credit card payments often involve significant processing fees that can erode profit margins. In contrast, crypto transactions can offer much lower costs, making them an attractive alternative for savvy business owners.

Crypto payments also open doors to entirely new markets. This innovative payment form attracts tech-savvy consumers who prefer modern payment solutions. Businesses catering to these demographics may experience growth and increased brand loyalty.

Security is a top priority for both businesses and consumers. Cryptocurrency provides advanced security protocols reducing the risk of fraud and chargebacks. Utilizing blockchain technology, crypto offers a more secure transaction environment.

Lastly, cryptocurrency enables companies to capitalize on global markets with ease. It removes the hurdles of currency conversion and the restrictions of traditional banking systems, facilitating seamless international transactions.

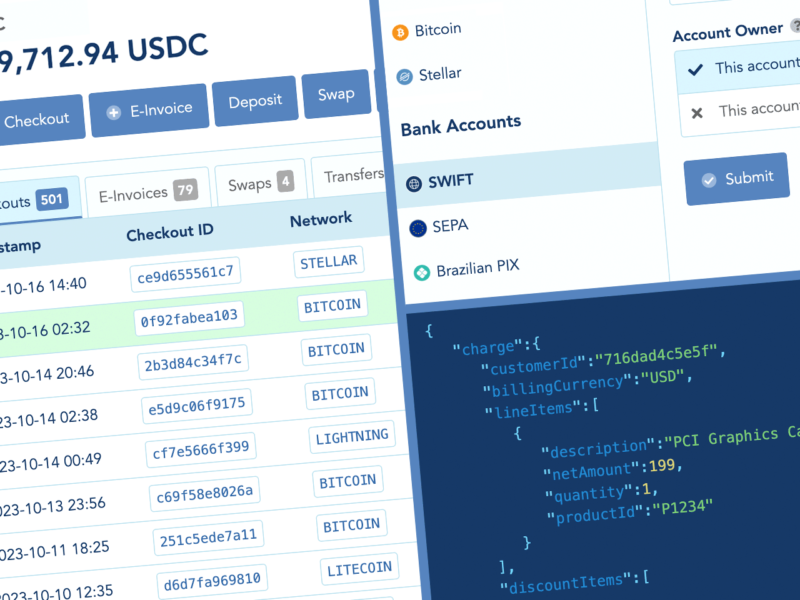

Implementing Cryptocurrency Payments

Choosing the Right Crypto Payment Gateway is crucial for businesses planning to accept digital currencies. Selecting a reliable and secure platform ensures smooth financial operations. Look for gateways offering instant conversion to avoid market volatility and protect revenue. Transaction fees, customer support, and geographical restrictions require careful consideration.

Integrating Crypto Payments with Existing Systems can be seamless with proper planning. Providers should deliver easy-to-use APIs complementing existing checkout processes. Ensure compatibility with your current accounting software to streamline bookkeeping and tax compliance tasks.

To ensure smooth operations, Educating Your Team on Crypto Transactions is essential. Training should cover the basics of cryptocurrency, transaction processing, and security protocols. This keeps the team informed, reduces errors, and enhances customer support for crypto payments.

:max_bytes(150000):strip_icc()/profitcentre.asp_Final-ad846c59a8c64f2ca0771d3224e95094.png)

Credit: www.investopedia.com

Navigating The Volatility Of Cryptocurrencies

Navigating the volatility of cryptocurrencies is crucial for businesses. Accepting digital currencies requires strategies to manage price fluctuations. A key method involves using crypto payment converters. These tools instantly convert crypto payments into traditional currency.

This process mitigates the risk of value changes in the cryptocurrency market. Businesses can set prices in their local currency. The converter ensures merchants receive the correct amount. Real-time conversion locks in the exchange rate at the transaction time. Businesses avoid potential losses from crypto volatility.

Price stability is vital for budgeting and forecasting. Converters offer stability. Here’s a table showing how converters can help:

| Issue | Solution |

|---|---|

| Price Volatility | Real-time Conversion |

| Risk of Holding Crypto | Instant Traditional Currency |

| Budgeting Concerns | Stable Exchange Rate |

Regulatory Compliance And Tax Implications

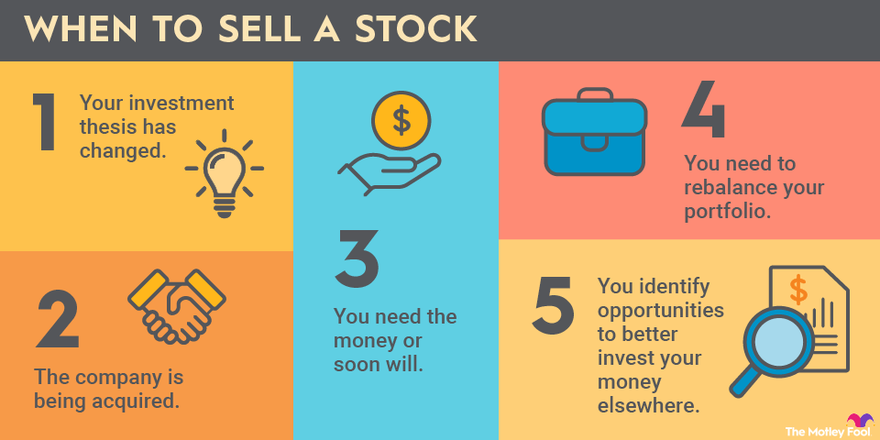

Business owners must know the rules for crypto. Understanding crypto regulations is vital. Laws change, so keep up-to-date. Each country’s crypto rules can differ. This means research is key.

Keep records of all crypto transactions. Tax obligations depend on these details. Income from crypto is often taxable. Know your local tax rates. Declare profits during tax filings. Deductions may apply, seek expert advice.

For record-keeping, details like dates, amounts, and values are needed. These show the transaction’s worth when executed. Such scrutiny helps avoid legal issues. Maintaining clear, precise records safeguards businesses.

Credit: www.fool.com

Real-world Success Stories

Many businesses are now flourishing after they chose to accept cryptocurrency. Stories of successful crypto integration are abundant and offer valuable insights for others. A renowned example is Overstock.com, an online retailer that began accepting Bitcoin in 2014.

This move gained massive media attention and became a case study on embracing digital currency. Similarly, Microsoft allowed crypto transactions for Xbox store credits, which boosted its modern and tech-savvy image. Their stories emphasize cryptocurrency’s potential to attract a global customer base.

Another sector experiencing a surge in crypto-based transactions is the travel industry. Companies like CheapAir and Destinia witnessed increased sales after they implemented crypto payments. These real-world cases indicate that crypto can lead to competitive advantage and customer satisfaction enhancement.

:max_bytes(150000):strip_icc()/businessincome_final-fdcbc653a7e049bab4707c62cf9cc407.png)

Credit: www.investopedia.com

Conclusion

Embracing cryptocurrency can propel your business into a new era of financial transactions. It’s a step forward in innovation and customer satisfaction. With its rising popularity, adopting digital currency now may prove beneficial long-term. Ensure your strategy is secure and informed.

The future is decentralized; be prepared to meet it.