[ad_1]

Although wellness is not a new concept, a global pandemic helped bring it once again to the forefront. Not only are more consumers interested in wellness, but they are now viewing it through a wider and more sophisticated lens.

It is no longer just about fitness and nutrition, but also overall physical and mental health. There are a wider variety of products available and customers are demanding clean, natural, products designed to improve health and well-being.

So, what does this have to do with cannabis? Everything! As perceptions change and social stigmas across age groups relax, a new sector is emerging. Somewhere between strict, medical-only use, and solely recreational use, is wellness.

We’re finding the cannabis industry targeting the self-care and wellness-minded consumer. This lucrative subsection of the billion-dollar cannabis industry will be instrumental in achieving mainstream acceptance of the plant.

Furthermore, MJBizDaily noted these wellness products have a greater appeal to those that intend to, but currently do not use cannabis.

Whether treating a specific medical condition, relaxing, creating mindfulness, exercising, substituting for other (less healthy) activities, or utilizing it as a beauty regimen, individuals are using cannabis for a variety of reasons and redefining wellness.

Many products that fall under the wellness label are categorized as medical. As this suggests, medical cannabis is splitting into two separate markets, medicinal to treat specific ailments, and wellness products for health and overall well-being.

Executives believe there is money to be made by capitalizing on both.

Medical

In 2021, 42% of cannabis users identified as medical consumers and 95% believed their conditions had improved with cannabis, with 56% reporting significant improvement.

The top five medical considerations consumers bought cannabis to treat were anxiety (41%), arthritis (29%), pain (29%), insomnia (18%), and migraines (17%).

Hundreds of millions of Americans experience each of these conditions; 20 million+ anxiety, 51 million+ arthritis, and 140 million+ pain, and many of them will consider trying it — particularly if existing consumers overwhelmingly report improvement.

Wellness

Wellness products for overall well-being, not specifically used for treating a certain condition, can be further delineated into subcategories such as relaxation and mental health, fitness, substitution, and cosmetics.

Consumer data from a research study conducted by New Frontier Data found nearly 23% of current cannabis consumers use cannabis to improve their overall health and wellness.

Wellness-specific uses for cannabis rank highest for relaxation (67%), stress relief (62%), reducing anxiety (54%), improving sleep quality (46%), and pain management (45%).

While many wellness uses are similar to medical uses, the key difference is that wellness consumers use cannabis for overall mental and physical well-being and support as opposed to use for specific conditions.

Men and women both report relaxation and stress relief as their leading reasons for cannabis use.

Fitness

The stereotype of the unhealthy, sedentary stoner is no longer accurate. A study using 10 years of data collected by the National Health and Nutrition Examination Survey (NHANES) found that any lifetime cannabis use was associated with higher odds of physical activity.

New Frontier Data reports that age is a factor when considering cannabis use as it relates to exercise. Those under 45 had a higher percentage of reported use of cannabis with exercise than those over 45, with the highest (13%), among consumers aged 35-44.

Substitution

Wellness-minded consumers are also replacing alcohol with cannabis as more than 81% of current users believe that cannabis is safer than alcohol.

While only 16% of consumers specifically list replacing alcohol as their reason for using cannabis, New Frontier Data reported 47% have replaced at least some of their alcohol use with cannabis.

Prescription medications are also being replaced for many users. Emerging research indicates that the increased use of cannabis as medicine has had a substitution effect on prescription drug use.

Several cross-sectional surveys report substituting cannabis for prescription drugs, of which opioids, antidepressants, and anti-anxiety drugs are the most prevalent.

The substitution of prescription drugs is the most common motive among users of medical cannabis, surpassing substitution rates for alcohol and illicit drugs.

Moreover, state medical cannabis laws in the United States have been associated with a sizeable reduction in prescription drugs, particularly opioid prescriptions, and with fewer prescription opioid-related hospitalizations, lower rates of opioid overdoses, and decreases in opioid-related healthcare costs.

Health and Beauty

Medicinal qualities in cannabis have created a demand for infused health and beauty products.

Antimicrobials, antioxidants, and other therapeutic properties contained in these skin care products are responsible for this segment’s growth, with the United States accounting for or 47% of the $5.45 billion global market, and women comprising two-thirds of consumers.

An estimated compound annual growth rate of 5.5% will increase the total market value to $10.9 billion by 2030, reported Global Newswire.

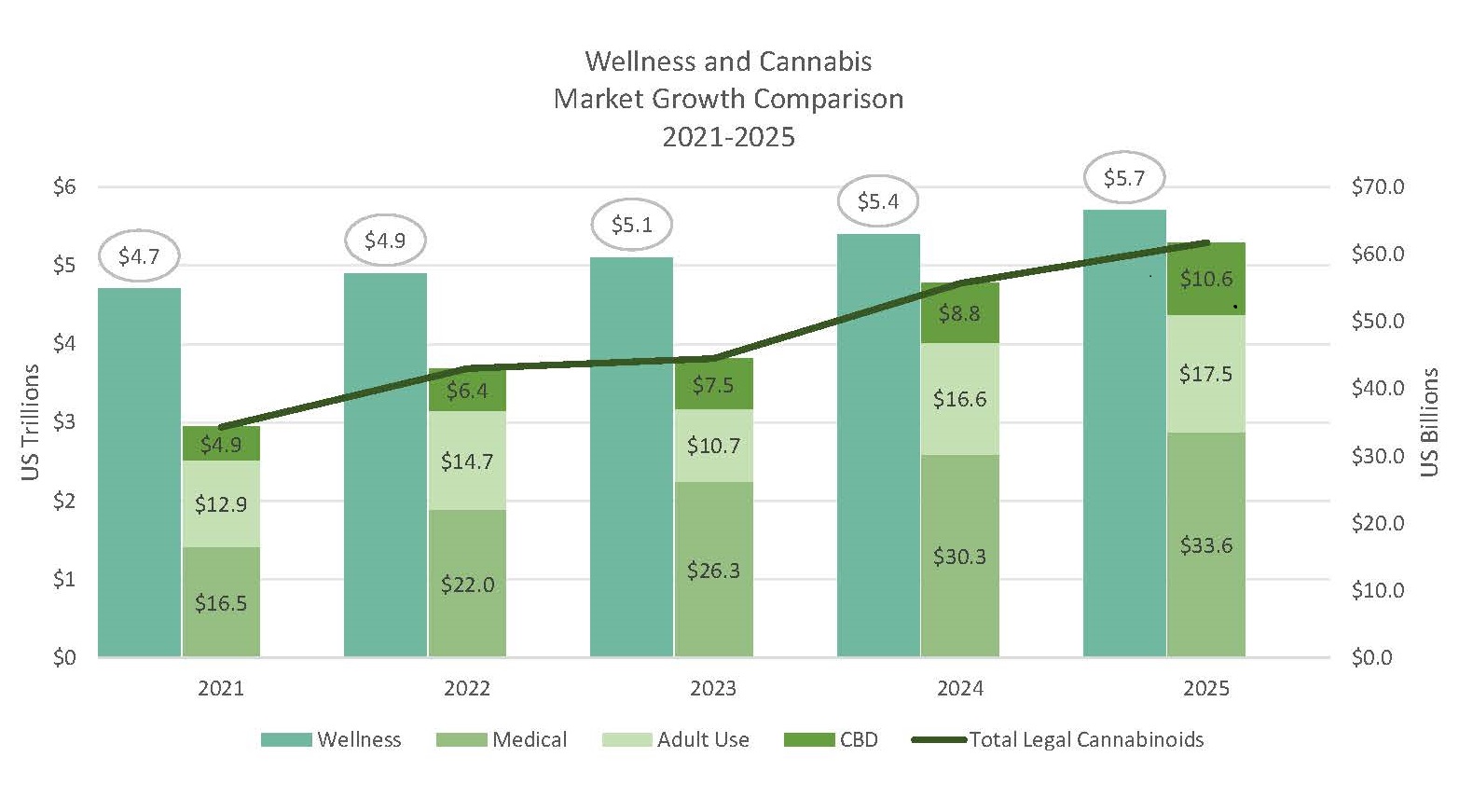

When you consider global wellness market values at US$4.5 trillion in 2022 and projected to increase by 2%-4% annually, and global cannabinoid market values at at US$27.7 billion with an annual projected growth rate of 25%, and by offering wellness products in subcategories that are already popular in the hemp-derived CBD market, estimated to reach $16B by 2025, there is an abundant future for wellness products in the cannabis space.

The aforementioned data was reported by the Global Wellness Institute, BDS Analytics, and Cowen Research, respectively.

At these cross-sections lies a unique opportunity for brands to develop specific effect-based products to capture their piece of the proverbial pie.

This article first appeared in Volume 4 Issue 4 of Cannabis & Tech Today. Read the full issue here.