[ad_1]

Venture capital funding in Europe is plummeting as investors shift focus from growth to cutting costs.

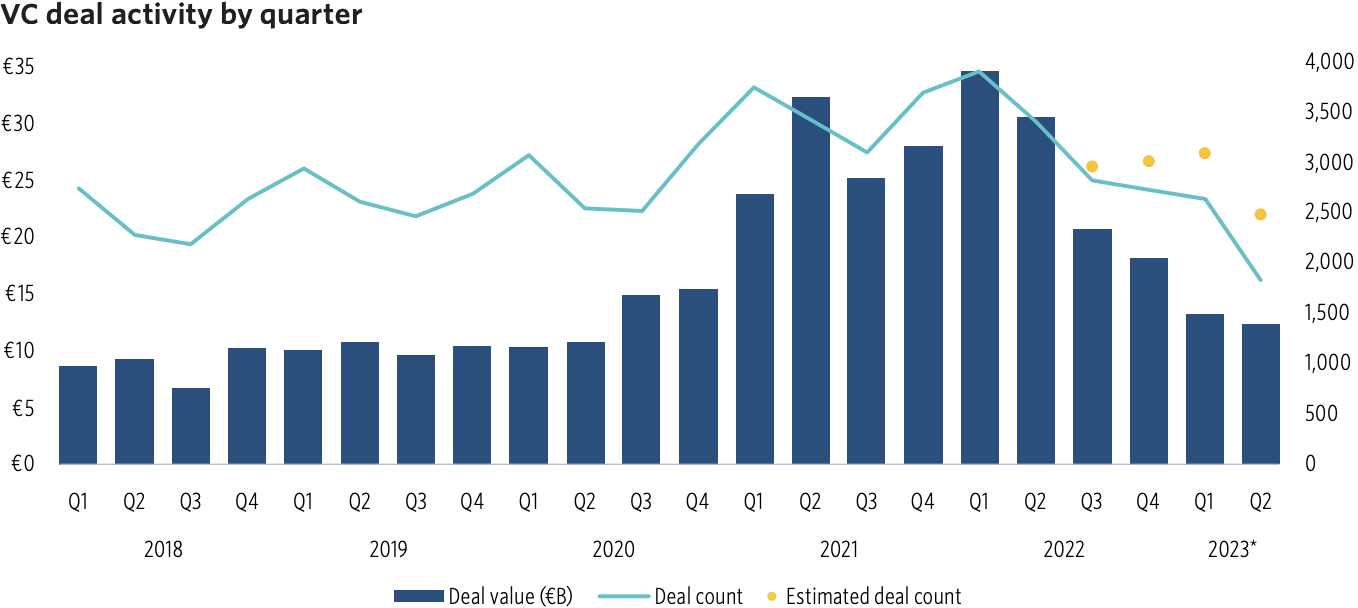

In the first half of 2023, European VC deal value was 61% lower than at the same time last year according to a new report by Pitchbook, a financial data firm.

The total capital raised in the continent was €8.9 billion. At the current rate, the full year is on track to pace 37% below 2022 levels.

Analysts blame the decline on surging interest rates, high inflation, fundraising hurdles, and a subdued IPO market.

These economic headwinds have prompted new investment strategies. Instead of prioritising growth at all costs, VCs are increasingly working with their startups to restructure operations and extend runways as far as possible.

A gloomy impact of this prudence is mass layoffs and hiring freezes at startups. British unicorn GoCardless, for instance, is cutting 15% of its global workforce as of June 2023. According to Pitchbook, startups with lower growth rates that need funding to survive are likely to face down rounds and valuation cuts. More companies are also likely to seek capital despite lower valuations.

This recently occurred at Getir, the Turkish food delivery app. In April, the company raised €435.5m from Abu Dhabi state fund Mubadala at a valuation of €5.7bn. Just a year earlier, the same investor had injected €690.7m into Getir at a valuation of €9.9bn. The new funding effectively slashed the startup’s value by 42.4%.

The cautious approach has depressed both value and volume of deals. Exit activity has slowed to decade lows, with corporate acquisitions now the most common exit option. Debt-heavy leveraged buyouts, however, have lost share.

US participation in European deals has also plunged. To date, American participation in VC deal value in 2023 is down 69% year-on-year.

The software sector, which laid the foundations for today’s VC industry, has been hit hard by the downturn. In the second quarter of 2023, the value of software deals dropped 71.8% year-on-year — more than any other sector.

“Just as the dot-com bubble reset the sector in 2000, we are seeing a similar reset from the bonanza of deals in 2021 and 2022,” said Pitchbook’s analysts.

Nonetheless, there are signs of hope. The generative AI investment boom could spur dealmaking for software startups in the space.

Sectors that are less cyclical in nature, such as biotech and pharma, have also shown resilience. A notable example of this is Ascend Gene And Cell Therapies. In May, the London-based startup raised €120.3m for its gene therapy tech.

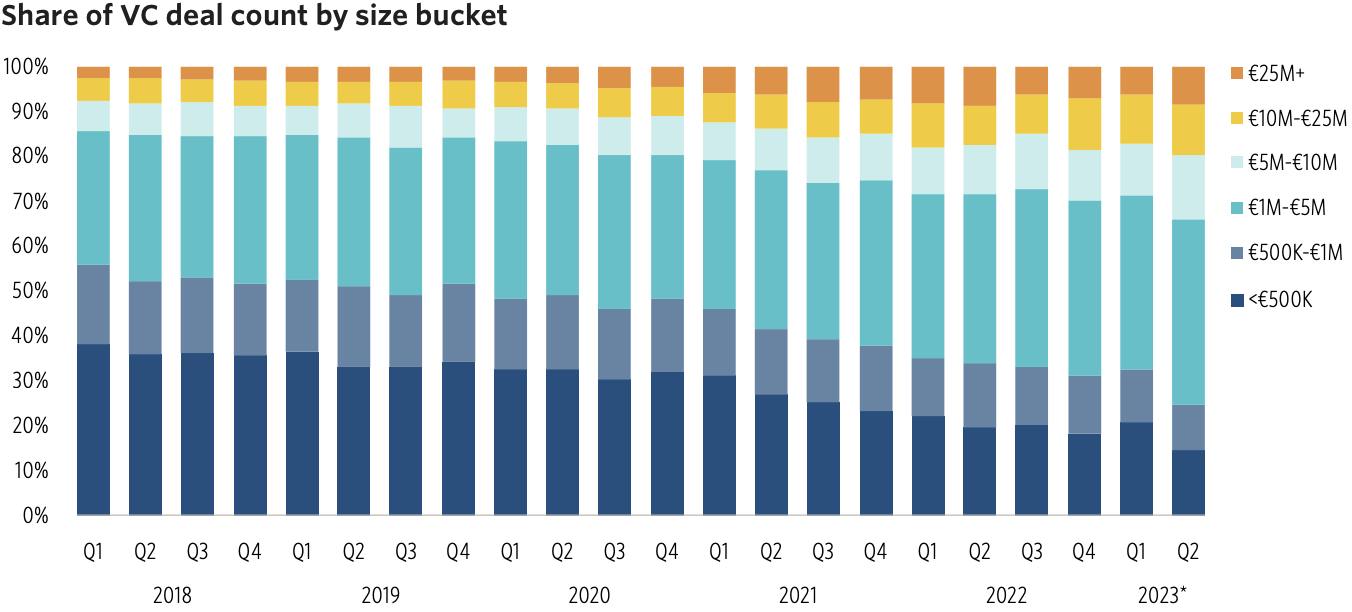

Overall, Pitchbook’s data suggests a trend towards larger deals, often as follow-on VC investments that provide extra runway to their startups. Venture growth stage and late-stage deals, meanwhile, have gained a growing share of the VC deal count, while the proportion in angel and seed stages has shrunk.

The findings add further evidence of the current difficulties in securing funding.

Mercifully, a recovery could be on the horizon — particularly in the US, where the Federal Reserve has suggested that monetary tightening will soon end. But in Europe, high inflation could lengthen the contractionary cycle.