Choosing between liquidation and administration depends on whether your business aims to close down or restructure. Liquidation suits a closure, while administration is best for restructuring.

Determining the right course of action when a business faces financial turmoil is crucial. Liquidation and administration are two routes that companies can take, but they serve very different purposes. Liquidation entails winding up a company’s affairs, leading to selling assets to pay creditors before shutting down.

Administration, on the other hand, aims to help a company in debt to operate while seeking a resolution or a potential recovery strategy. It buys time for a business to reorganize or find new investment. Businesses should consider the viability of future operations, the interests of the creditors, and the potential to preserve the company’s value when deciding between these two options. The chosen path can significantly influence the business’s likelihood of survival or the nature of its closure.

Credit: fastercapital.com

Liquidation And Administration: Vital Business Turnaround Tools

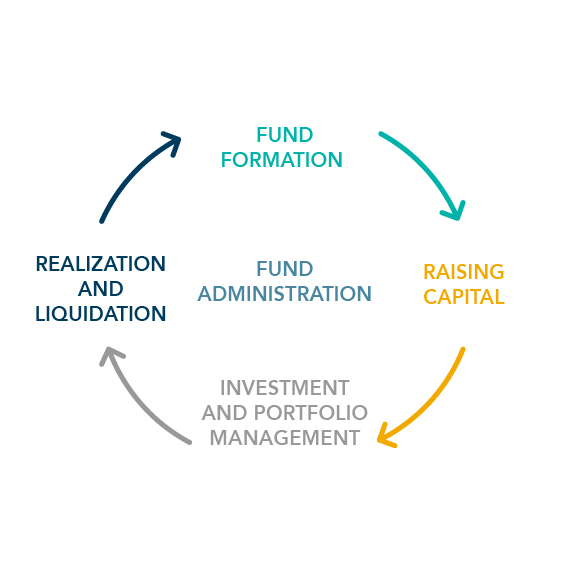

Liquidation is when a business closes and sells its assets. It pays off debts with the proceeds. This path is often chosen when recovery seems unlikely. The goal is to wrap up affairs fairly and within legal guidelines. Administration, on the other hand, is a bid to rescue a struggling company. A specialist steps in to manage the business. Administration aims to save the company, or at least get better results for creditors than closure would offer.

The process of administration seeks to protect the company from legal actions. An appointed administrator evaluates the business. They devise a plan that could involve restructuring or seeking new investment. It favors survival and keeping jobs safe. Administration can provide a lifeline to businesses with the potential for a turnaround.

Credit: www.cscgfm.com

Diving Into Liquidation: When It’s The Only Option

Liquidation signals a tough period for a business, indicating the end of operations. There are two main types: involuntary and voluntary liquidation. The former isn’t a choice; creditors force it when a business cannot pay its debts. The latter is when company owners decide to cease operations.

Both scenarios deeply affect creditors and employees. Creditors may receive some payment from asset sales. Yet, they often get back only a fraction of what the company owes. Employees face job loss and uncertainty, but may receive outstanding wages before other debts are paid.

The final step is dissolving the company. Once all assets are sold and debts paid as much as possible, the business closes forever. This step ensures the company legally stops existing and can no longer incur debt or do business.

The Administration Route: Aiming For Recovery

An administrator’s role is to rescue a struggling business. They have wide knowledge and skills to help businesses.

Their main goal is to create a plan that can save the business and help it grow again. The plan may cut costs or find new money sources.

This process affects many people. Workers may keep their jobs. Shareholders might lose some of their investment.

Creditors could get back more money than if the business closed. Customers can still buy products or services.

Credit: www.facebook.com

Comparative Insights: Factors Influencing The Choice

Understanding your business’s financial health is crucial. Liquidation may occur if debts overwhelm assets. Administration aims to save a company, restructuring debts. Each process varies in its impact on assets, operations, and growth potential. Legal implications also differ significantly.

Administrators have duties to creditors, overseeing the business’s affairs. Liquidators, on the other hand, conclude a business’s operations. Owners must grasp their responsibilities in both scenarios. They must also consider long-term consequences. Liquidation often results in business closure. Administration can enable future trading, potentially safeguarding the business’s legacy.

Real-world Scenarios: Successes And Failures

Liquidation and administration can lead to varied results for businesses.

Successful liquidations often entail selling assets to pay off debts. These actions can limit financial damage and preserve reputations. Blockbuster’s liquidation in 2013 serves as a notable example, where it closed stores but managed to clear debts.

For administration success, look at Gateway, which restructured operations in 1993. Through this process, Gateway secured its finances and reduced liabilities, emerging stronger. Administration often helps companies to remain active while addressing debt issues.

Key lessons suggest thorough evaluation is critical. Company directors must assess both options. Understanding every possible outcome helps make sound business decisions. Learning from past cases, executives can steer their companies towards more positive outcomes.

Navigating The Decision: Expert Advice And Legal Counsel

Business owners facing financial dilemmas often consider liquidation or administration. Expert advice is vital in such tough situations. Consulting financial advisors is a helpful step towards a wise decision. They help decipher complex financial statements, simplifying options on the table.

Furthermore, engaging with legal professionals is crucial. They understand the legal landscape and can outline potential outcomes. This ensures all actions comply with current laws.

Both steps guide leaders in making an informed choice for their business’s future. Decisions shaped by professional insights can prevent unnecessary complications and financial loss.

Conclusion

Navigating financial distress demands careful consideration. Liquidation and administration offer distinct paths for struggling businesses. Your choice should align with long-term goals and immediate needs. Seek expert advice to determine the most beneficial route. Remember, the right decision can pave the way for recovery or a fresh start.