Selling shares in your business can inject vital capital and spread risk. It may also attract strategic partners to foster growth.

Selling shares in a company is an essential strategy for businesses seeking to expand or reinforce their financial stability. This move offers an influx of funds which can be pivotal for scaling operations, investing in new technology, or entering new markets.

By offloading a portion of equity, business owners can leverage the cash for immediate needs or long-term investment without incurring debt. It opens the door to pooling a diverse range of skills and experiences as investors often bring their expertise to the table. These strategic investors contribute not only financially but also by providing valuable insights and networking opportunities, which can be instrumental in steering the company towards greater success. Selling shares further dilutes the ownership, which means risks are shared among a greater number of stakeholders, potentially leading to more stable and resilient business operations.

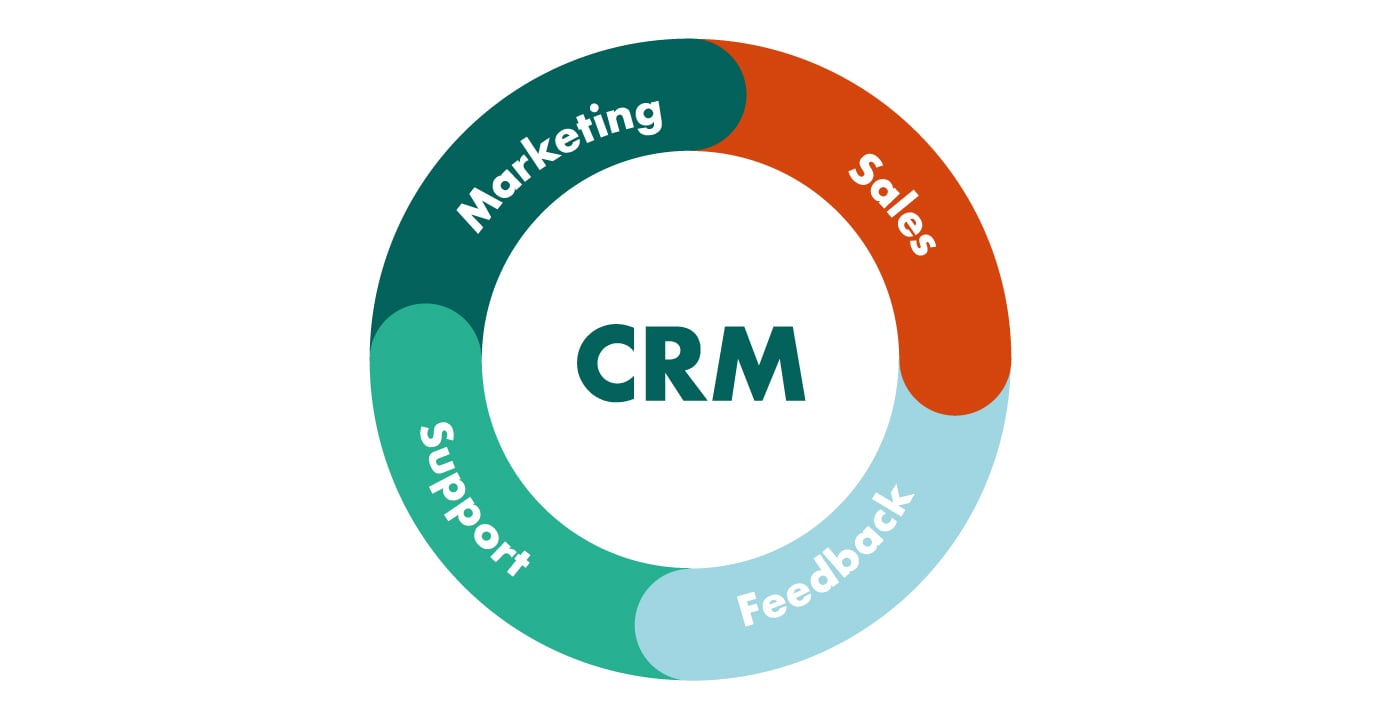

Credit: www.superoffice.com

The Mechanics Of Selling Shares

Selling shares in your business can unlock capital for growth and expansion. This can be initiated through an Initial Public Offering (IPO), a step that transforms a private company into a public entity. The IPO process involves legal and financial steps, offering shares to public investors for the first time.

Following an IPO, companies may opt for secondary offerings. This provides an avenue for raising more funds or enabling major shareholders to sell their stakes. Despite diluting the ownership, secondary offerings could have a positive impact by introducing new investors and potential strategic allies.

Capital Influx: Fuel For Expansion

Selling shares in your business unlocks capital. This money can grow your company. Investing it in important areas is key. One main use is for upgrading infrastructure. Better equipment and facilities lead to more efficiency and high production.

Another advantage is a boost in research and development (R&D). This can lead to new products or improved services. With extra funds, businesses can explore fresh ideas. This often results in staying ahead of competitors. Ultimately, selling shares can support sustainable growth.

Shareholder Value: A Driver For Success

Sharing ownership of your business can lead to greater success. It shows trust and transparency towards investors. These qualities are crucial for building investor confidence. A strong relationship with shareholders can lead to long-term financial health for your company.

A company’s stock performance often reflects its success. High stock prices can suggest that investors believe in the business. This trust can increase the company’s value. A high-performing stock can attract more investors. This can mean more money for your company to grow.

Credit: www.facebook.com

Strategic Alliances Through Share Sales

Selling shares in your business opens doors to strategic growth. By attracting strategic investors, businesses gain not only capital, but valuable expertise and connections. These partnerships often lead to innovative products and market expansion. Strategic alliances, formed through share sales, can significantly boost a company’s competitive edge.

Bringing in investors with aligned interests and visions can result in mutual benefits. Joint ventures emerge from strong partnerships, tapping into new customer bases and leveraging each other’s strengths. Effective collaboration can usher in new business opportunities, fostering a strong foundation for growth.

Risks And Considerations

Selling shares in your business might bring in vital capital. Yet, shareholders will own a part of your business. This is dilution of ownership. You will share decisions and profits with others.

Also, the stock market is unpredictable. Share prices change fast. Choosing the right time to sell shares needs care. Timing affects how much money you raise.

Real-world Success Stories

Many startups have soared after opening their shares to the public. Companies like Facebook and Amazon showed massive growth post-IPO. Their success stories inspire many.

Public investment can bring fresh funds and market confidence. This often leads to rapid expansion and innovation. Such moves prove crucial for scaling up business operations.

- Facebook’s IPO: A game-changer that led to global expansion.

- Amazon: Used public funds to revolutionize online shopping experience.

- Alibaba: Emerged as an e-commerce titan after going public.

Credit: www.facebook.com

Conclusion

Selling shares in your business isn’t just about raising capital. It’s a strategic choice that opens doors to diverse expertise and shared risk. It’s clear that bringing investors on board can set the stage for expansion and innovation. Smart entrepreneurs recognize this as an opportunity to scale and evolve.

Embrace the potential; it could be the best move for your business’s future.